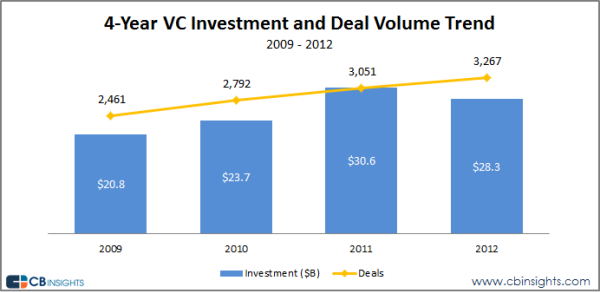

According to Venture capital database CB Insights, the total number of U.S. Venture Investments in 2012 was $28.3 billion – a large figure that actually was slightly down from the $30.6 billion raised in 2011.

With several key economic indicators signaling an upturn in the U.S. economy, perhaps there is another reason why venture funding was flat (or slightly down) from year-to-year. Considering the worldwide fundraising phenomenon, called crowdfunding (where proof of concept is supported by the general masses instead of a few with deep pockets), perhaps resources are being driven in new directions? In fact, the crowdfunding solution has helped people all over the world amass billions of dollars in funding for new endeavors. According to a recent industry report by Massolution, global crowdfunding raised nearly $2.7 billion for more than 1 million campaigns in 2012. This means that the crowdfunding market grew by more than 80 percent from 2011. And it is just at the beginning of its growth cycle, unlike other types of capital raising techniques.

Reasons for using crowdfunding for raising capital are vast, yet unique to the individuals leveraging the 500-plus platforms currently operating today.

But the crowdfunding option also comes with its challenges, especially for those who have been very successful in raising money for their new inventions, startups or nonprofits. What’s interesting is that for dreamers, sometimes raising the money is the simple part – turning these dreams into a reality (with a large crowd keeping an eye on their progress) proves to be much more of a challenge. Problems with order fulfillment, scaling a new business, constant communication with backers and managing the community are all big challenges faced in the past, present and will continue in the future. Keep in mind that through the traditional route of securing funding, investors typically address these challenges upfront and demand plans for overcoming these issues well before making investments, but in crowdfunding, fundraisers are tapping numerous individuals for donations on a much smaller scale –trusting in the individual business acumen and decision-making skills of the fundraiser(s) along with supporting a passion for the same dream to be realized that they too share.

For example, Ethan Mollick, a professor of management at the Wharton School of the University of Pennsylvania, conducted a study and found that a large majority of crowdfunding participants meet their commitments to their backers, but that more than 75 percent of them deliver said commitments (mostly physical goods) later than expected. In general though, most project funders understand delays, as long as communication between the two parties is constant and comprehensible. But, again, there are many examples where just keeping up with the communications between dreamers and their supporters can consume more time than delivering the product to market.

“Great things in business are never done by one person, they’re done by a team of people,” said Steve Jobs, the late CEO of Apple.

A successful businessperson with all the experience in the world will also likely be the first person to admit that they were only as successful as the team around them. In other words, not one person can do everything, and especially in today’s startup climate, we all need a team of people and/or third-party vendors to support our goals. According to a 2009 study conducted by the Ewing Marion Kauffman Foundation, the average cost of starting a new business from scratch is estimated at just over $30,000. Think of everything included within this $30,000 (which also depends on the nature of the business itself). Most businesses require office space, computer and office equipment, accounting services, legal services, IT services, administrative services and more.

Most small businesses fail because of two main reasons: lack of experience and lack of funding.

One great attribute of the U.S. (and several other countries across the world) is the focus and support on small business development.

Small businesses are the lifeblood to economic stability and the dynamo that increases wealth amongst citizens. What people may not know is there are numerous available resources to gain assistance, guidance, and mentorship for starting a new endeavor. Organizations like SCORE, a nonprofit association comprised of 13,000+ volunteer business counselors throughout the U.S.) and Startup America, a White House initiative to celebrate, inspire, and accelerate high-growth entrepreneurship throughout the nation) are just two of several major support systems for small business and entrepreneurism. I’d also urge people to find a local Small Business Development Center within their community and to tap a local business incubator found through the National Business Incubation Association.

For these reasons, the next generation of crowdfunding platforms needs to include new capabilities such as peer review, networking and expert support, which are key fundamentals for helping any startup have a greater chance of becoming successful. By intertwining the funding event with additional opportunities for education and support (via free and paid resources as well as expert consultancy), a new ecosystem is created whereby the opportunity for greater business transaction can be achieved.

In today’s age, I want people to understand there are support mechanisms available for anyone, equal opportunities to start a new venture and with the aid of resources like technology, anything is possible. Whether you are trying to secure venture funding or funding from the crowd, there are several billions of dollars up for grabs and anyone has a chance to claim their piece of the pie. Whatever you choose to do in life, just know that you can creatively define your own destiny. There is always a way to achieve a dream and there are always people and organizations to help support your passions.

Jason Graf is the founder and concept-creator of CrowdIt. A SCORE mentor and avid entrepreneur, Graf has an unwavering drive to improve small business and startup success in the U.S. and all over the world.