I recently came across a fascinating call on The Ramsey Show that perfectly captures a dynamic I see in many relationships – even wealthy ones. The caller, Marie, described her 64-year-old husband, who manages half a billion dollars professionally yet obsessively turns off lights, bans avocados if one goes bad, and keeps their home at a frigid 65 degrees at night.

What struck me most wasn’t just the behavior but how it exists despite their significant wealth. They own their homes outright, buy new cars with cash, and have millions in assets. This isn’t about money—it’s about something much deeper.

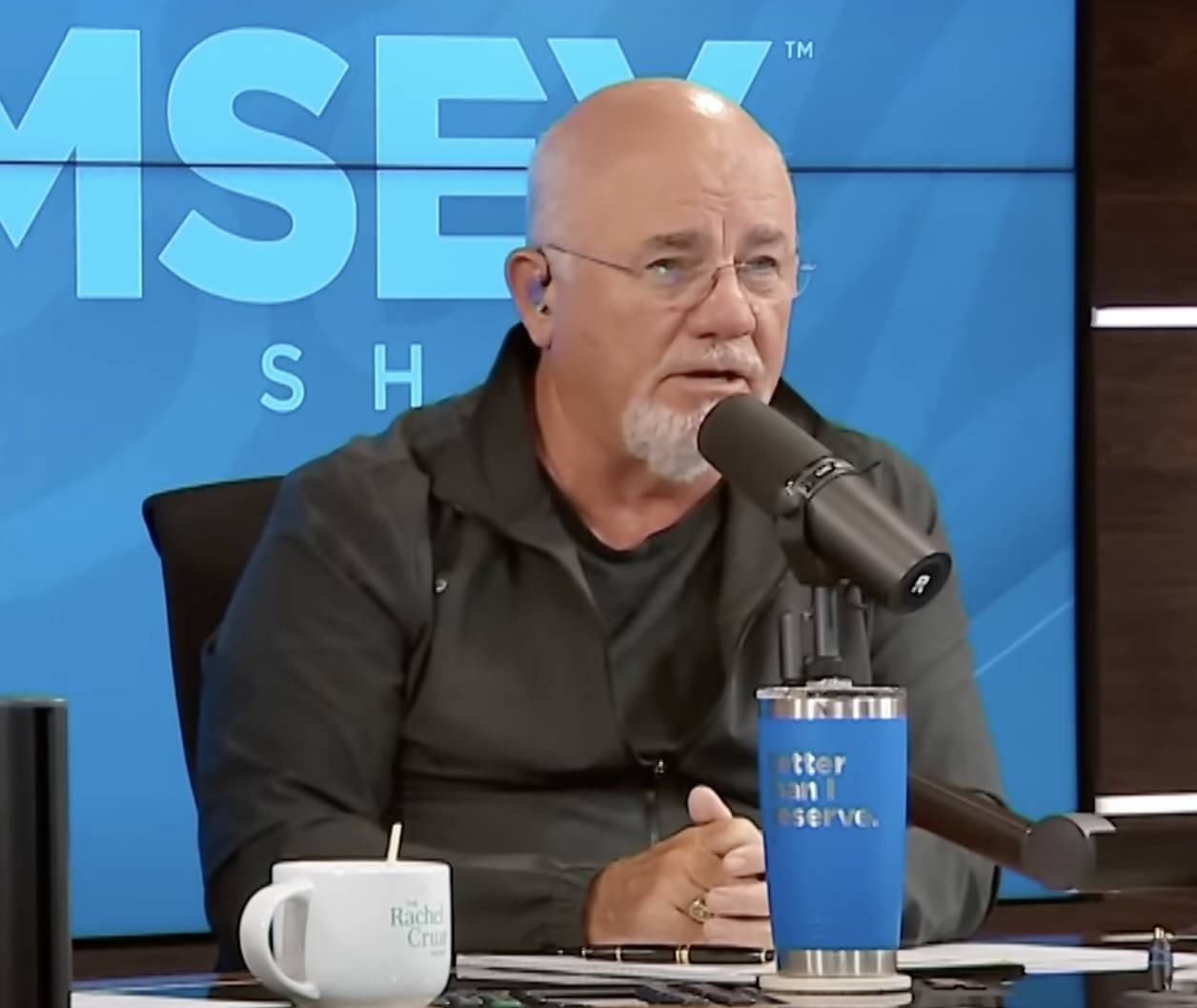

Dave Ramsey immediately identified what many of us miss when dealing with financial anxiety: This isn’t a money issue at all. It’s an emotional and spiritual problem.

The Psychology Behind Financial Control

Marie’s husband isn’t being deliberately mean. He’s trapped in a scarcity mindset disconnected from their financial reality. Dave pointed out that he’s likely still trying to please his mother, who was described as highly frugal despite having wealth.

This resonates with many clients I’ve worked with. Financial behaviors are often rooted in childhood experiences and family dynamics. The husband’s actions represent a form of control that provides security but at a significant cost to his freedom and relationship.

Think about it – can you imagine walking through life feeling responsible for every light left on or food item that spoils? The mental burden must be exhausting. As Dave noted, “He’s not living in freedom at all.”

When Money Becomes an Idol

What’s particularly interesting is how Dave frames this as a spiritual issue. We typically think of money worship as materialism or overspending, but obsessive frugality can be equally problematic. When saving becomes an end rather than a means, it transforms into what Dave calls “idolatry.

The husband has become so fixated on minor expenses that he’s lost perspective on what matters. Their relationship suffers while he stresses over a $2 avocado or a few cents of electricity – despite having millions in assets.

I frequently see this disconnect between financial reality and behavior. People who:

- Have substantial retirement savings but won’t spend $20 on a dinner out

- Own their homes outright but worry about the cost of basic home maintenance

- Have significant investment portfolios but stress about grocery prices

The anxiety isn’t proportional to the actual financial risk, suggesting deeper psychological factors at play.

Breaking the Cycle of Financial Anxiety

Dave offered Marie practical advice that applies to many relationships with financial tension. First, she needs to stop enabling the behavior through her own anxiety (hiding avocados, stressing about purchases). This codependence only reinforces the problem.

Second, professional help might be necessary. A good counselor can help the husband see his behavior objectively and explore its roots. Since he’s not malicious – just controlled by fear – there’s hope for change once he recognizes the problem.

I find Dave’s compassionate approach particularly valuable. He acknowledges the husband isn’t trying to be difficult — he’s trapped in patterns that likely stem from childhood experiences. This understanding creates space for growth rather than judgment.

Finding Balance in Financial Freedom

The ultimate goal isn’t just changing specific behaviors but finding true financial peace. As Dave explains, this couple needs to intentionally decide how to use their wealth to align with their values, whether enjoying certain comforts, giving to causes they care about, or planning for the future.

What I appreciate most about Dave’s advice is his recognition that financial freedom isn’t just about having money — it’s about your relationship with it. You can be wealthy but miserable if money controls you rather than serving your goals and values.

For Marie and her husband, the path forward requires honest communication, possibly professional support, and a willingness to examine the emotional roots of financial behavior. Most importantly, it requires breaking the connection between minor expenses and emotional security.

As Dave so colorfully put it, they could “throw avocados at the dog as a ball” and still be financially secure. The challenge is helping her husband truly believe that at an emotional level, not just intellectually.

This story reminds us that financial wellness isn’t just about the numbers – it’s about having a healthy relationship with money that enhances rather than diminishes our lives and relationships.

Frequently Asked Questions

Q: How can someone address extreme frugality in their partner without causing conflict?

Start by approaching the conversation with empathy rather than criticism. Focus on how the behavior affects you emotionally and the relationship rather than attacking their character. Consider suggesting professional counseling to explore the roots of these behaviors together in a safe environment.

Q: Can extreme penny-pinching be a sign of a mental health issue?

Yes, in some cases, extreme frugality that’s disconnected from financial reality could indicate anxiety disorders, obsessive-compulsive tendencies, or trauma responses related to past financial insecurity. When these behaviors significantly impact quality of life or relationships, professional help may be beneficial.

Q: Why do some wealthy people still worry about small expenses?

This often stems from deeply ingrained habits formed during childhood or periods of financial struggle. The behaviors that helped someone build wealth (careful spending, saving) can become rigid patterns that don’t adjust when circumstances change. Additionally, some people find their identity in frugality, making it difficult to change even when financially unnecessary.

Q: What’s the difference between healthy frugality and problematic penny-pinching?

Healthy frugality aligns with your values and financial goals without causing significant stress or relationship problems. It involves mindful choices about spending priorities. Problematic penny-pinching causes anxiety and conflicts in relationships and prevents the enjoyment of resources you can reasonably afford. The key difference is whether the behavior enhances or diminishes your quality of life.